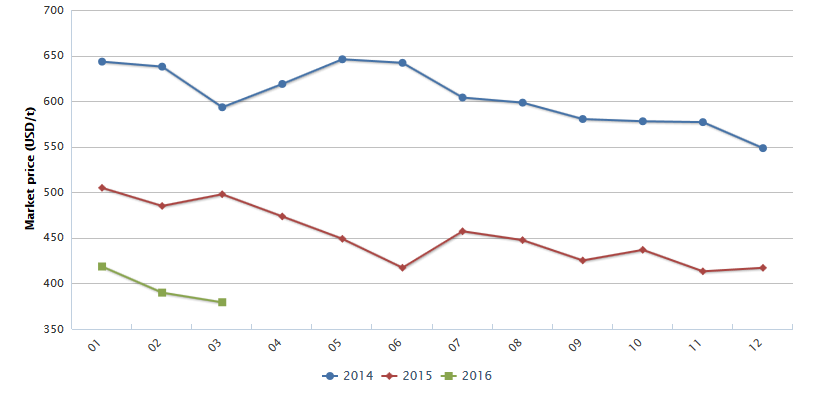

Q1 2016, China's market price of soybean meal keeps falling after suffering

from a small rebound in Dec. 2015. According to CCM, the average market price

is USD379.29/t (RMB2,480/t) in March 2016, down by 23.8% YoY and down by 10.7%

MoM.

It is known that there are following factors driving down the soybean meal

price:

-

The United States Department of Agriculture

(USDA) released, on 9 March, to increase the prediction of the end-of-quarter

inventory of American soybean in 2015/16 from 10 million bushels to 460 million

bushels due to the falling soybean meal price. USDA estimated that the soybean

price will be USD8.50/bushel in year 2016, which will be lower than

USD8.80/bushel last year. Obviously, the dropping soybean price drags down the

market price of soybean meal.

-

After the Spring Festival, a large amount

of live pigs enter the market for sale intensively, which is a traditional

slack season for the downstream feed enterprises. Therefore, the downstream

demand for soybean meal (raw material of feed) declines.

Market price of soybean meal in China, Jan. 2014-March 2016

Source: CCM

It is forecasted that the soybean meal price would continue to fall after Q1

2016.

Firstly, the supply of soybean is sufficient. The high-yield South American

soybean can support China's demand and the import price remains at low level.

According to the Brazil Oilseed Report released by the counselor of the

overseas agricultural department of the USDA, the output of 2015/16 soybean is

predicted to hit a record high, being 100 million tonnes in Brazil. Analyst

AgRural also estimated that the soybean output will increase by 3.6% over

2014/15.

In addition, Mauricio Macri, new President of Argentina has reduced

the export tariff of soybean from 35% to 30%, spurring up the export volume of

soybean at the same time reducing the import cost for China. Therefore, CCM

predicted that the import price of soybean would further decline and then will drive

down the soybean meal price.

Secondly, the supply of soybean meal is sufficient. As the prices of soybean

and soybean oil remain stable, the oil extraction plants are willing to

purchase soybean and their operating rates maintain at medium level. Therefore,

the output and supply of soybean meal are abundant with stable inventory, which

compresses the market price. According to CCM, the average operating rate of

oil extraction plants was 58.4% and 62.6% in Jan. and March 2016 respectively.

Thirdly, data from the Ministry of Agriculture of the People's Republic of

China show that the number of adult sows in farms was 37.60 million in Feb.

2016, down 7.9% year on year and down 0.6% month on month, constant declines

for 30 consecutive months.

And the number of live pigs in farms was 366.71

million in Feb. 2016, down 5.5% year on year and down 1.8% month on month.

Since the number of live pigs for sale recovers slowly, it is estimated that

the demand for soybean meal is still not high in later period. The oversupply

situation is still there, which means that the soybean meal price will keep

falling.

This article comes from Corn Products China News 1603, CCM

About CCM:

CCM is the leading market intelligence provider for China’s

agriculture, chemicals, food & ingredients and life science markets.

Founded in 2001, CCM offers a range of data and content solutions, from price

and trade data to industry newsletters and customized market research reports.

Our clients include Monsanto, DuPont, Shell, Bayer, and Syngenta. CCM is a

brand of Kcomber Inc.

For more information about CCM, please

visit www.cnchemicals.com or get in touch with us

directly by emailing econtact@cnchemicals.com or calling

+86-20-37616606.

Tag: soybean